GOVERNOR PROPOSES $300 MILLION HIGHWAY FUNDING PLAN

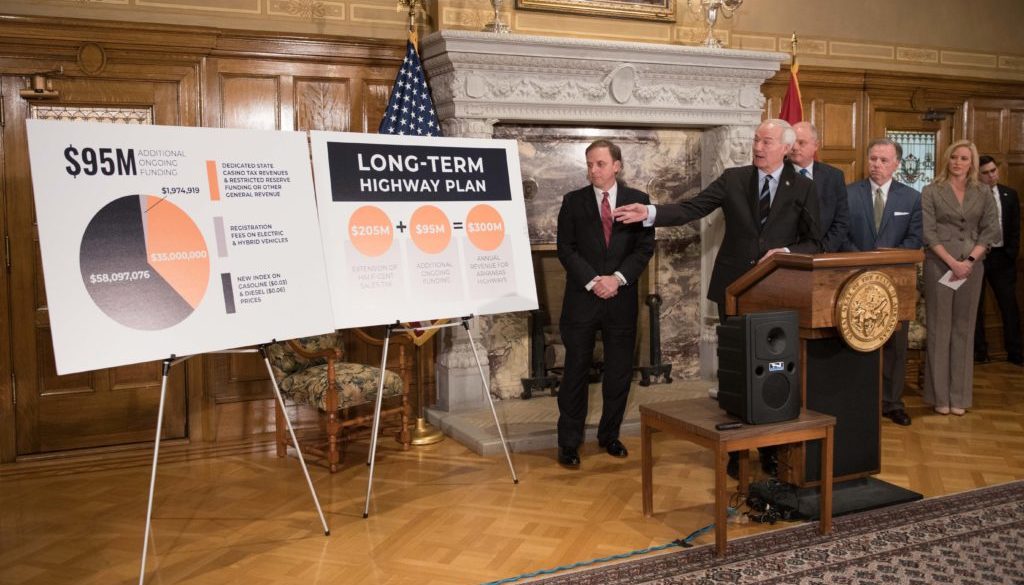

Gov. Asa Hutchinson announces his highway plan as (from left) House Speaker Matthew Shepherd, Senate President Pro Tempore Jim Hendren, Arkansas Good Roads Foundation Executive Director Joe Quinn and Arkansas Trucking Association President Shannon Newton look on. (Photo courtesy of Governor’s Office)

By Steve Brawner, Talk Business & Politics, Feb. 11, 2019

Gov. Asa Hutchinson and legislative leaders revealed a highway plan Monday that would provide $300 million annually to state highways and another $110 million to cities and counties, primarily by extending a half-cent sales tax for 10 years and also by enacting gasoline and diesel taxes.

The tax extension, which would raise $206 million annually, would have to be approved by voters in 2020. Voters passed the tax in 2012 to fund the Connecting Arkansas Program. Legislators must refer the extension to voters.

That program relied on bond issues where 28% was consumed through financing costs. If passed, the extension would fund roads on a “pay as you go” basis.

The plan would raise another $58 million per year by enacting a wholesale gas tax that would be the equivalent of 3 cents per gallon, and it would do the same on diesel fuel that would be the equivalent of 6 cents per gallon. That tax could increase by a maximum of one-tenth of one cent per year.

It would raise a minimum of $35 million from new casino tax revenues, restricted reserve funds and other general revenue sources. Voters passed a constitutional amendment in November allowing four casinos to operate in Arkansas.

Finally, it would raise almost $2 million by imposing additional fees on users of hybrid and electric vehicles.

Those taxes could be passed with a simple majority vote in the Legislature.

The program also would provide $110 million annually for cities and counties. It would do this by continuing the traditional split of roughly 70% for highways, 15% for cities and 15% for counties.

In a press conference, Hutchinson called this the “largest single highway plan in our history.” It would allow the state to maintain its interstates, improve the most-traveled roads, and replace every structurally deficient bridge.

Hutchinson said it is the “top dollar amount that in my judgment the people of Arkansas can afford.” He said it would provide the right balance between limiting tax increases and meeting highway needs.

A bill is in draft form and is expected to be filed this week, Hutchinson said. But first, legislators must pass the governor’s income tax plan that would reduce the top rate from 6.9% to 5.9%. That tax cut has passed the Senate but faced problems in the House with some lawmakers who wanted to see the highway plan first.

Hutchinson said that even with the tax increases included in the plan, Arkansans will still see a net tax decrease because of the governor’s previous tax cuts and a reduction in the grocery tax.

Speaker of the House Matthew Shepherd, R-El Dorado, said he believed legislators will support the plan.

Shannon Newton, Arkansas Trucking Association president, said her organization supports the plan, explaining that “Arkansas highways are our workplace.”

Joe Quinn, Arkansas Good Roads Foundation executive director, praised the plan, calling it “meaningful.” He related that on Friday, he had bought his daughter a new tire and repaired a tire rim damaged by a pothole.

Asked if he had a wish list for how the money might be spent, Hutchinson said, “I will not get into that today.”

DEMOCRATS COUNTER TAX CUTS

There has been some Republican reluctance to endorse Hutchinson’s $97 million tax cut plan in the Legislature, partly due to the lack of a highway proposal. Democrats mostly oppose the tax cut plan, although three Democratic senators voted for passage of it last week in that chamber.

On Monday, as a counter message to the governor’s highway proposal and an alternative to his tax cut plan, House Democrats rolled out an Earned Income Tax Credit (EITC) measure that would create a 10% tax credit for lower-wage earners.

House Minority Leader Rep. Charles Blake, D-Little Rock, freshman Rep. Tippi McCullough, D-Little Rock, and members of the Democratic caucus unveiled the proposal. The plan would eliminate the governor’s proposed tax cut for the top 1% of Arkansans, a move they claim would cost $73 million, and create the 10% Earned Income Tax Credit.

“Arkansans want tax relief. Arkansans were promised tax relief. I know we all want a tax plan that makes sense for our economy and provides help for our working families. The current plan being championed by our governor fails on both counts. A tax plan that will stimulate real growth in the Arkansas economy needs to be focused on providing tax relief to our working class,” Blake said.

McCullough added, “History tells us time and time again that the most effective form of tax relief occurs when we put more money in the hands of the people who will spend it and put back into our economy. My values and my faith tell me that we should always try to do the most good, for the most people. I believe this legislation passes both of those tests. It will benefit 300,000 working families.”

Democrats hold 24 seats in the 100-member House.